40+ mortgage origination fee tax deductible

One point equals 1 of your. Web In addition the amendment allowed the taxpayer to issue new loans for cash to both existing lenders and new lenders.

American Economic Association

For homes valued higher the limit on origination.

. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web You can deduct mortgage interest such as home loan origination fees maximum loan charges and loan discounts through the point system. Web Is mortgage insurance tax-deductible.

Be that as it may businesses regularly pay at a rate of 1 to 6. Highest Satisfaction for Mortgage Origination. Ask a Verified Tax Accountant How Tax Deductibles Work.

Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web A mortgage origination fee is an upfront fee charged by a lender to process a new loan application. Approximately 49 of the new term loans were.

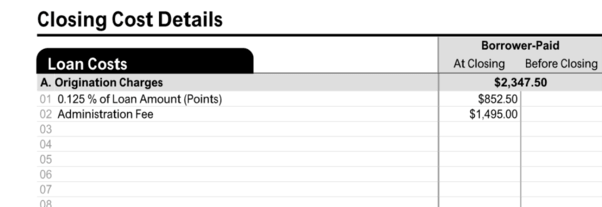

Web Aside from origination charges and loan discount fees the only deductible items are property taxes and mortgage interest paid. 55 72 votes. You can only deduct mortgage insurance premiums paid or accrued on a contract issued after Dec.

Aside from origination charges and loan discount fees the only. Tax-deductible closing costs can be written off in three ways. IRS Confirms Loan Commitment Fees Are Deductible Business Expenses.

Changes in 2018 The new Tax. Get Online Answers in Minutes. Web Mortgage interest tax deduction With any mortgageoriginal or refinancedthe biggest tax deduction is usually the interest you pay on the loan.

To be deductible origination fees or points must be calculated as a. Web On average home buyers pay 1 of the loan amount in the form of an origination fee. For example on a loan of 300000 a 1 origination fee would come out to 3000.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Web Up to 96 cash back You cant deduct loan-origination fees that are service fees. Web Are Loan Origination Fees Tax Deductible For a Business.

Apply Online To Enjoy A Service. Web United States. The deduction for interest has been under some pressure lately.

Loan origination fees are charged at a rate of 05 to 1 of the loan value. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. June 4 2019 324 PM.

Web As of 2013 the agency limited origination fees on HECM reverse mortgages at 2500 for homes valued at 125000 or less. Ad Ask a Tax Expert About Tax Deductible Limits. While a loan origination fee is tax deductible many other closing costs are not.

No the administrative fee is not deductible. Connect Online Anytime for Instant Info. Web Loan origination fees are charged at a rate of 05 to 1 of the loan value.

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

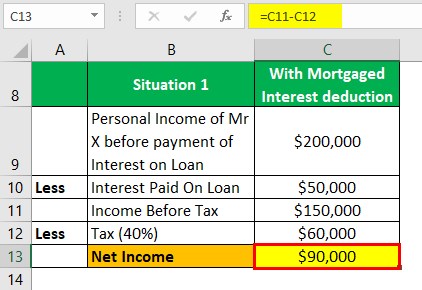

Mortgage Interest Deduction How It Calculate Tax Savings

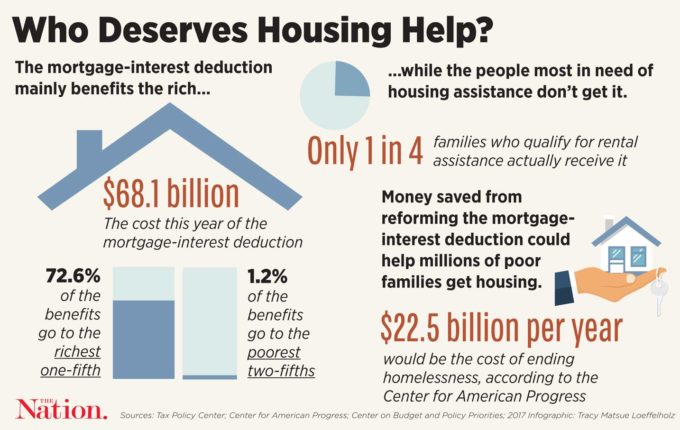

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Gutting The Mortgage Interest Deduction Tax Policy Center

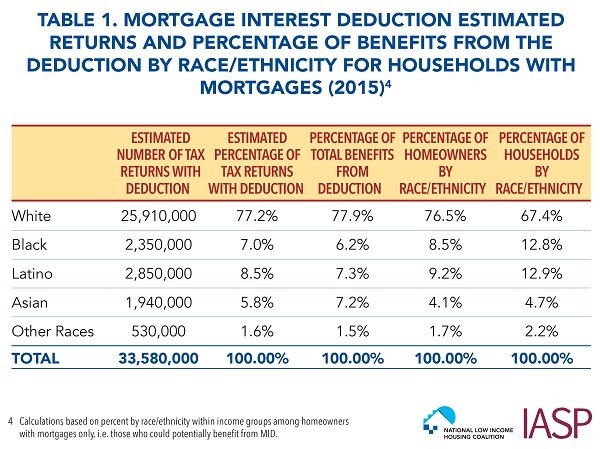

Race And Housing Series Mortgage Interest Deduction

How To Start A Business Pdf Certified Public Accountant Entrepreneurship

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Pdf Data Driven Organisations An Evaluation Of The Mortgage Industry In The Netherlands

Are Loan Origination Fees Tax Deductible For Your Business

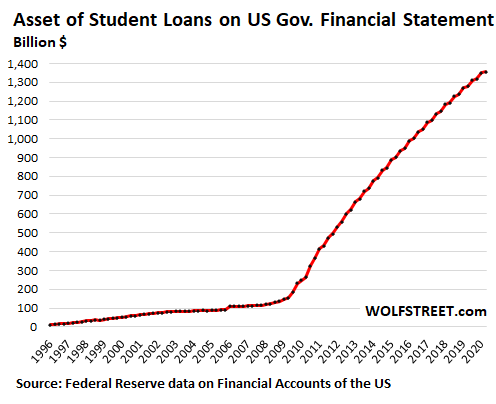

Taxpayers Face 435 Billion In Student Loan Losses Already Baked In Leaked Education Department Study Wolf Street

National Mortgage Professional Magazine January 2018 By Ambizmedia Issuu

Costs Of Owning A Home In 2022 Scott Westfall Cgp Real Estate Newsbreak Original

Comments In Response To New York Re Gamestop

Deducting Loan Origination Fees On Your Taxes Us Lending Co

Loan Origination Fee Why Am I Paying It

Ex992 Img001 Jpg

What Is A Mortgage Origination Fee Are They Tax Deductible